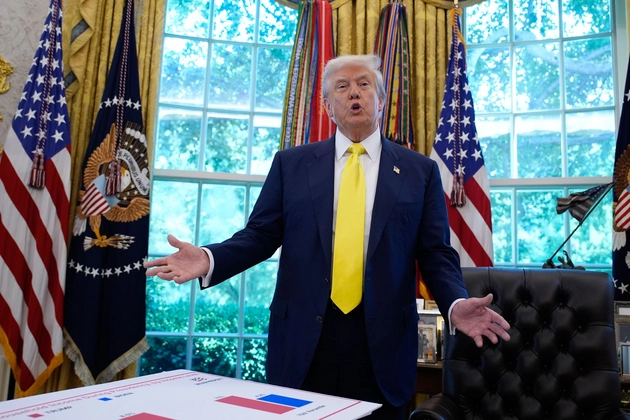

U.S. Inflation Rose in June as Trump’s Tariffs Began to Take Effect

- Small Town American Media

- Jul 17, 2025

- 2 min read

Inflation picked up in June, with new federal data showing the clearest signs yet that President Trump’s 2025 tariffs are beginning to ripple through the U.S. economy. From groceries and gasoline to furniture and appliances, prices across a range of goods are climbing—raising concerns among economists and leaving the Federal Reserve in a wait-and-see mode.

According to the Bureau of Labor Statistics, the Consumer Price Index rose 2.7% in June compared to a year earlier, marking the fastest pace since February. The increase was higher than analysts expected.

So-called “core” inflation—which excludes food and energy, and is closely watched by policymakers—rose even more sharply at 2.9% over the past year. Month to month, overall prices continued to increase.

Many of the price increases were concentrated in categories directly affected by the administration’s tariffs. Household furnishings rose in June, up from the month before. Appliance prices nearly doubled. Clothing, which had seen falling prices earlier in the year, reversed course and rose. Gasoline prices also jumped .

These shifts come as the first wave of tariffs—part of President Trump’s expansive trade crackdown—takes hold. While the full effect has yet to be felt, economists say the June figures offer an early snapshot of how businesses and consumers are beginning to bear the cost.

The dilemma facing many businesses is familiar: absorb the added cost or pass it along to consumers. For some, it’s already showing up in price tags. For others, the decision could come down to profits—or survival.

Meanwhile, the Federal Reserve is watching carefully. It hasn’t changed interest rates since January, trying not to act too quickly while inflation stays under control. But now that prices are rising and growth is slowing, some experts say the Fed may have fewer options moving forward.

What the Fed hopes to avoid is a situation where inflation continues to rise while economic growth stalls—a scenario economists refer to as stagflation. Prior to the tariff escalation, that risk seemed to be fading. Now, it’s resurfacing.

The Federal Reserve is expected to keep interest rates unchanged for now, with its next policy meeting scheduled for July 30. They want more clarity before making a move—especially with other policy changes underway, including tax adjustments, immigration restrictions, and deregulation efforts.

.png)